Multifamily Blogs

Failure to Comply With Deposit Notifications Could be Costly

Failure to Comply With Deposit Notifications Could be Costly

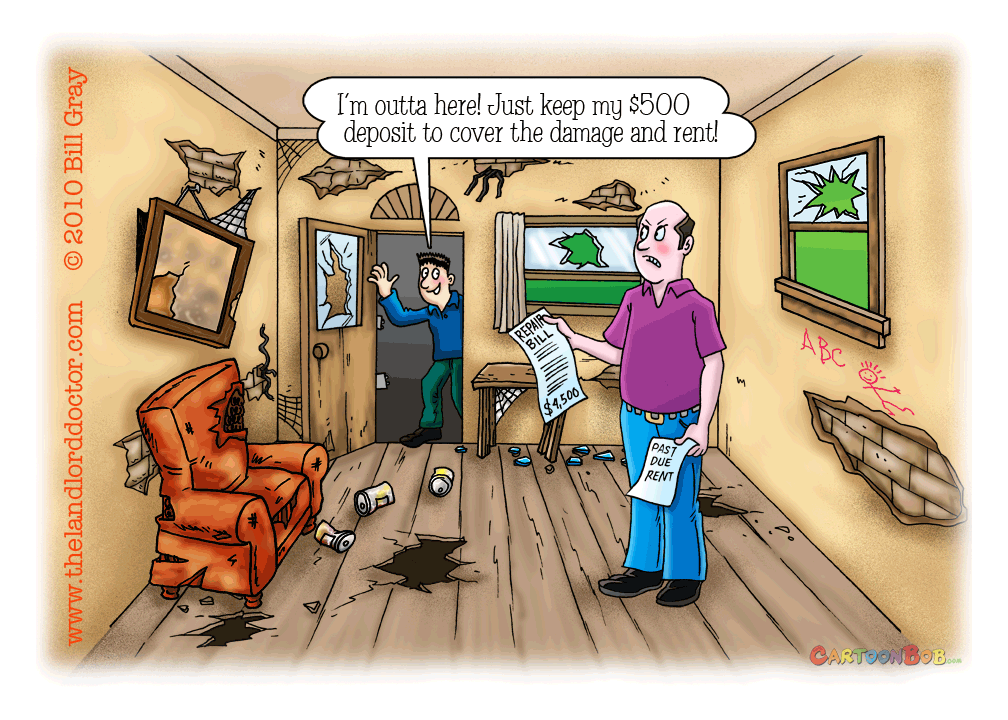

Imagine being forced to write a check to a previous tenant who still owes you money. This is a very real possibility if you fail to comply with the law after the tenant moves out. With the amounts and occurrences of tenant debt rising, having to pay a previous tenant who still owes you money only adds insult to injury.

Imagine being forced to write a check to a previous tenant who still owes you money. This is a very real possibility if you fail to comply with the law after the tenant moves out. With the amounts and occurrences of tenant debt rising, having to pay a previous tenant who still owes you money only adds insult to injury.

In most states, landlords and property managers are required to notify their tenant if they do not intend to refund the tenants deposit after they move out. States vary in the required timeframe and method of notification, but most do require it. This notification is referred to in various terms such as SODA (Statement of Deposit Account), Deposit Disposition, Final Account Statement, etc. Some states require the notice be sent via certified mail, while others accept First Class mail notification. I advise landlords to mail this notice via Certified Mail, whether the state requires it or not. Sending it Certified Mail provides you with a receipt proving you mailed it and complied with the law.

Failing to notify your previous tenant of how you intend to apply the deposit he paid you may end up costing yourself even more money! Regardless of the unpaid rent, damages, eviction legal fees, etc., if you fail to notify the tenant as required by law in most states, the tenant can demand his deposit back.

Let’s say the tenant paid a $1,000 deposit on a twelve-month lease. Six months into the lease, the tenant skipped, leaving your rental trashed and owing you a month’s rent. Once you calculate your losses, you determine that the tenant owes you $3,000. After subtracting the $1,000 deposit, you are in the red $2,000.

If in this scenario you do not notify the tenant of how you intend to apply the $1,000 deposit toward the $3,000 loss, the tenant in many cases could demand his $1,000 back, regardless of what he owes you. Yes, he may have to sue you to get the deposit back, but if you have violated the law, he most likely will win.

So, take a look at what your failure to comply with the law may cost you in addition to a big headache. Immediately, you have cost yourself the $1,000 deposit plus any legal fees you paid to defend yourself in court. A quick Google search will give you further proof, revealing a number of class action suits against landlords and property management companies who failed to notify past tenants of how the deposit was applied.

In many cases, you might not have a forwarding address to mail the notice to. Your only option is to mail the notice to the last known address, which is the address of your rental. Half or more of these notices will be returned to you as undeliverable or having a wrong address. File the returned mail with the tenant’s file and save it. You may need the returned mail as proof that you did attempt to send the notification.

Comply with your state’s deposit notification law. Doing so may save you money.

The information contained in this article is provided for informational purposes only, and should not be construed to be legal advice. Consult a local landlord-tenant attorney to discuss your specific situation.

Email me your tenant screening and tenant debt questions.

Bill Gray

This email address is being protected from spambots. You need JavaScript enabled to view it.

Copyright 2010 – Click here to reprint/re-post